The Bradbury Pound in 1914 is the model for what more and more people are waking up to:

The Bradbury Pound in 1914 is the model for what more and more people are waking up to:

- banks create ‘money’ from thin air as Credit and charge interest for it;

- central banks lend it to governments – at interest – as national or public debt – as ‘public spending borrowing requirement’;

- governments have gradually handed over their monetary sovereignty and seignorage to the City;

- the myths surrounding money are being perpetuated by teaching institutions such as the London School of Economics which does not teach what ‘money’ is or who has the power to create it and how:

- the difference between interest-free Cash and interest-bearing Credit.

This ‘Writ of Mandamus‘ is a fresh approach to get the Government to act in the public interest (not just pay lip service).

It deserves support in any shape and form!

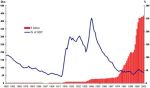

We demand that the British Government issues through its Treasury debt-free and interest-free money

……..as it did in 1914!

Overview of our country’s current ‘debt’ situation: Continue reading

by RSS

by RSS