This article is my answer to the invitation by Will Sharp, editor of Left Foot Forward. He asked for less than 500 words:

An economy describes activities that people perform to make a living through money. However, the fundamental difference between Cash and Credit are rarely the object of enquiry among economists. In fact, the daughter of Ellen Brown, author of The Web of Debt, wanted to write her PhD on money creation. But she was told by a professor at the London School Economics that “this is not capitalism”.

The strength of capitalism is not capital. It is the passive income that is generated through interest payments and the control over those who are forced to make such payments. It happens to individuals thanks to loan sharks and landlords. It happens to companies thanks to banks and other institutions. And it happens to nation states. That is least understood; possibly because when dealing with big numbers and enter a state of glazing rather than thinking.

We are told that government income comes either from taxation or from borrowing. However, the government prints notes and mints coins. The difference between the costs and the face value is called seigniorage and is also government income. This income item does not get mentioned in any of the budgets of the last nine years. I published an analysis of the figures on my blog on Public Debts with Vested Interest Payments under And the Government’s budget? A sharp increase in the “necessity to borrow” set in when the crisis happened.

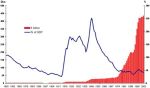

But the more money the government would print and spend into the economy, the more seigniorage it would receive. Instead, it pays out interest payments that tend to be as high as the military budget. Furthermore, an annual deficit between income and expenditure is built in, and the Public Sector Borrowing Requirement (PSBR) ensures that the debt spiral continues. In fact, Labour established the Debt Management Office that published the growth of the debt since 1855.

But the more money the government would print and spend into the economy, the more seigniorage it would receive. Instead, it pays out interest payments that tend to be as high as the military budget. Furthermore, an annual deficit between income and expenditure is built in, and the Public Sector Borrowing Requirement (PSBR) ensures that the debt spiral continues. In fact, Labour established the Debt Management Office that published the growth of the debt since 1855.

There are many aspects of the national debt, all of which contribute to an economy that can never become sustainable. As long as public debts increase, they are used to enslave national governments by organisations such as the EU and the IMF:

- The first national debt was established with the creation of the Bank of England in 1694: £1.2 million at 8% to allow William III to fight a war against France.

- The intention of the writers of the Act was not to oppress Their Majesties’ subjects. Austin Mitchell MP tabled an Early Day Motion to enforce the act. See http://edm1297.info

- The principle of the national debt has been exported to all nation states with the effect that all countries are in debt. The CIA Factbook publishes a ranking according to public debt with the UK in position 22.

And thus the UK follows the pattern that economics professor Michel Chossudovsky describes in his excellent video The Global Financial Crisis: the centralization of corporate power, the concentration of wealth and the globalization of poverty – unless Robin Hood becomes really active!

by RSS

by RSS

Pingback: Public Debts as the Root Cause of Unsustainable Economies «

I enjoy your U.K. perspective on the national debt run-ups. Maybe you will find this paper from economists Reinhart and Rogoff insightful. They take a look at the tradeoff effect between debt/income growth and income growth:

http://blogs.wsj.com/economics/2010/01/04/reinhart-and-rogoff-higher-debt-may-stunt-economic-growth/tab/article/

Keep up the good work!

Many thanks indeed!

Interesting article! I always wonder why people like to see national debt growth in relation to GDP growth.

Isn’t it enough to see money as a pot that gets produced by certain privileged people so that it can go around whole nations?

Thanks, Sabine.

National debt is unnecessary because there is no law that requires governments to borrow from private financial institutions. I estimate that if land values were taxed properly (worth £300-400bn, updated from the Labour Land Campaign estimate, 2002) when taken with green taxes and levies on wealth, it could raise more than half the government’s revenue required for 2010/11, generate a surplus and enable four existing taxes (income tax, council tax, business rate and inheritance tax) and the national debt to be phased out.

Yes, yes, Ken, one therefore wonders why the myth is perpetuated that the Government NEEDS toeither tax or borrow…

There are two reasons for taxation. One is to regulate the money supply and the use of natural resources, and the other is to capture economic rents such as land values or the benefit of money issuance (seignorage) for public benefit. Taxing labour or productive enterprise makes no sense. Borrowing by the government instead of issuing its own credit makes no sense. Vested interests promote this myth as part of an ideological cult. blogs like yours provide a valuable service in exploding such myths.